Category:

TIPS

TIPS

January 13, 2025

January 13, 2025

How Dubai Real Estate Works: A Guide for Investors and Homebuyers

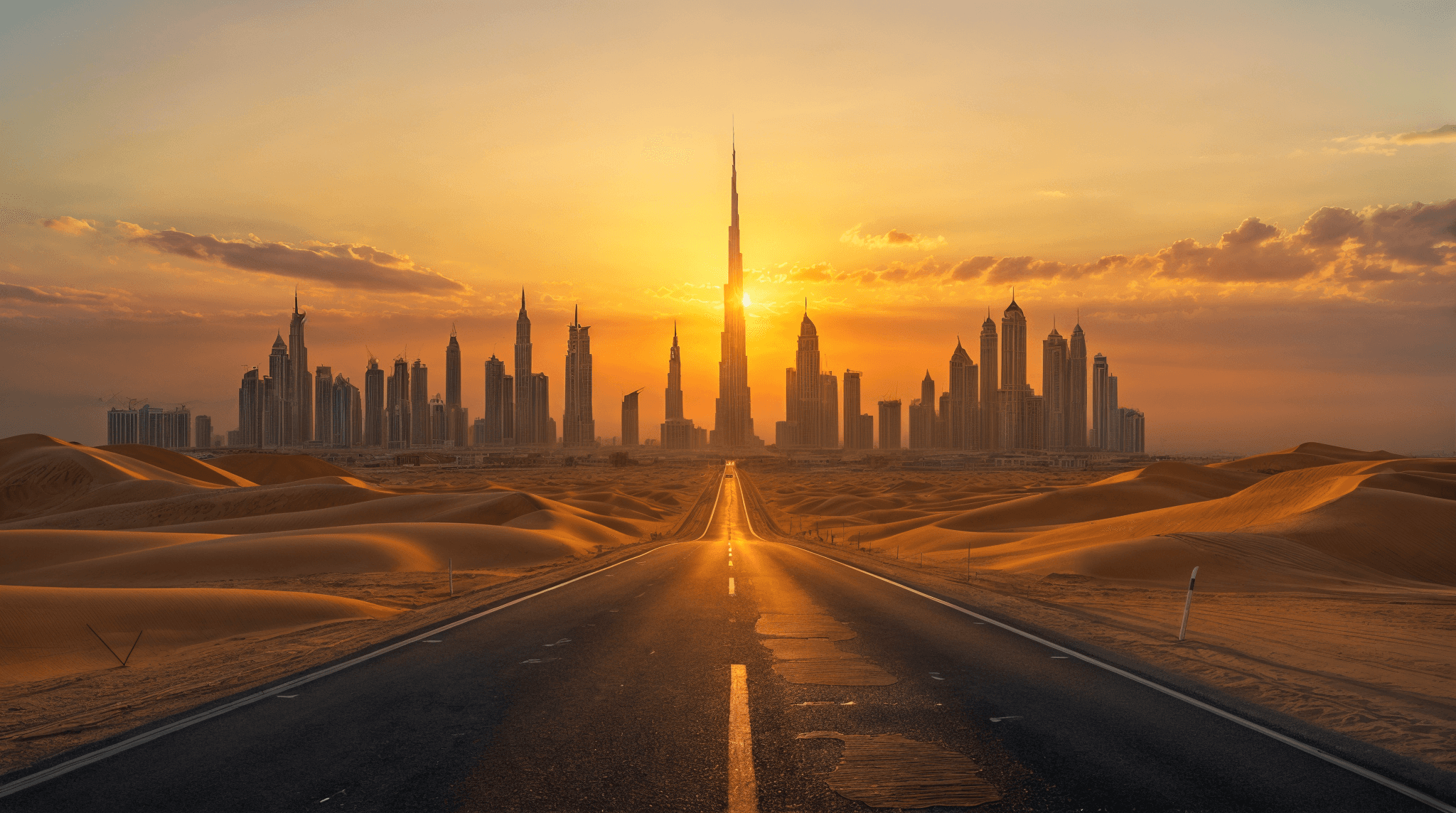

Dubai’s real estate market is one of the most dynamic in the world, attracting global investors and homebuyers with its luxurious properties, tax advantages, and robust infrastructure. Understanding the intricacies of how Dubai real estate works is crucial for making informed decisions and maximizing returns, whether you’re a first-time buyer or a seasoned investor.

Dubai's Real Estate Landscape

An Overview of Dubai's Real Estate Market Growth

Dubai’s real estate sector has seen exponential growth over the past few decades, with milestones such as the introduction of freehold property laws in 2002. Key players, including top developers like Emaar and Damac, alongside supportive government policies, have transformed Dubai into a global real estate hub.

Types of Properties Available in Dubai

Freehold Properties: Full ownership rights available to foreigners in designated zones.

Leasehold Properties: Long-term lease agreements, typically for 99 years.

Off-Plan Properties: Properties under construction, often offered at attractive prices with flexible payment plans.

Key Locations for Investment

Downtown Dubai: Home to iconic landmarks like the Burj Khalifa.

Palm Jumeirah: A luxury island community.

Dubai Marina: A vibrant waterfront district.

Emerging Areas: Spots like Jumeirah Village Circle (JVC) and Dubai South are gaining traction among investors.

Legal Framework and Property Ownership in Dubai

Property Ownership Laws for Foreigners

Foreigners can own properties in designated freehold zones, such as Dubai Marina and Downtown. Owning property in Dubai comes with several benefits, including eligibility for residency visas and access to a tax-free environment.

Real Estate Regulations

The Dubai Land Department (DLD) oversees property transactions, ensuring transparency and compliance. The Real Estate Regulatory Agency (RERA) protects buyers by regulating the market and ensuring developers meet their obligations.

Title Deeds and Registration Process

All property purchases must be registered with the DLD to secure ownership rights. Title deeds serve as official proof of ownership and are critical for legal security.

The Buying Process

Finding the Right Property

Buyers can work with experienced real estate agencies or explore online property platforms such as Bayut and Property Finder to discover suitable options.

Financing Your Purchase

Mortgage options are available for both residents and non-residents, with eligibility depending on income, age, and credit history. Banks typically finance up to 75% of the property value for non-residents.

Negotiating and Closing the Deal

The process includes making an offer, signing a Memorandum of Understanding (MoU), and completing payments. Ownership transfer is finalized at the DLD.

Renting and Leasing in Dubai

How Renting Works in Dubai

Lease agreements outline the responsibilities of both tenants and landlords. Key terms include rental duration, payment schedules, and maintenance responsibilities.

Property Management Services

Investors living abroad can benefit from hiring property management companies to handle tenant relationships, maintenance, and rental income collection.

Taxes and Costs to Consider

Fees and Charges

Registration Fees: Paid to the DLD during property registration.

Broker Commissions: Typically 2% of the property price.

Service Charges: Cover building maintenance and amenities.

Tax Implications

Dubai’s tax-free policy on rental income and capital gains is a significant advantage. However, a 5% VAT applies to certain property transactions, such as commercial real estate.

Challenges and Risks in Dubai Real Estate

Market Fluctuations

The market can be volatile. Investors can mitigate risks by diversifying portfolios and focusing on high-demand locations.

Fraud and Scams

Buyers should verify the credentials of developers and agents. Ensuring the property’s title deed is valid and conducting due diligence are essential steps.

Selling Property in Dubai

Steps to Sell Property

Prepare the property by addressing maintenance issues and enhancing its visual appeal. Listing it on prominent platforms can attract potential buyers.

Working with Real Estate Agents

Agents can help streamline the selling process by providing market insights, managing listings, and negotiating on your behalf.

Why Dubai Real Estate Is a Smart Investment

High ROI for Investors

Dubai offers some of the highest rental yields globally, with rates ranging from 5% to 8% in prime areas.

Residency Visa Benefits

Investors can obtain a UAE residency visa by purchasing property worth AED 750,000 or more.

Stability and Growth Potential

Dubai’s long-term economic growth plans and infrastructure development ensure sustained demand in the real estate sector.

Conclusion

Dubai’s real estate market offers immense opportunities for investors and homebuyers. By understanding how Dubai real estate works, you can make confident and profitable decisions. For expert guidance, partner with Property Solvers real estate Agency to unlock the full potential of Dubai’s real estate market.

Dubai’s real estate market is one of the most dynamic in the world, attracting global investors and homebuyers with its luxurious properties, tax advantages, and robust infrastructure. Understanding the intricacies of how Dubai real estate works is crucial for making informed decisions and maximizing returns, whether you’re a first-time buyer or a seasoned investor.

Dubai's Real Estate Landscape

An Overview of Dubai's Real Estate Market Growth

Dubai’s real estate sector has seen exponential growth over the past few decades, with milestones such as the introduction of freehold property laws in 2002. Key players, including top developers like Emaar and Damac, alongside supportive government policies, have transformed Dubai into a global real estate hub.

Types of Properties Available in Dubai

Freehold Properties: Full ownership rights available to foreigners in designated zones.

Leasehold Properties: Long-term lease agreements, typically for 99 years.

Off-Plan Properties: Properties under construction, often offered at attractive prices with flexible payment plans.

Key Locations for Investment

Downtown Dubai: Home to iconic landmarks like the Burj Khalifa.

Palm Jumeirah: A luxury island community.

Dubai Marina: A vibrant waterfront district.

Emerging Areas: Spots like Jumeirah Village Circle (JVC) and Dubai South are gaining traction among investors.

Legal Framework and Property Ownership in Dubai

Property Ownership Laws for Foreigners

Foreigners can own properties in designated freehold zones, such as Dubai Marina and Downtown. Owning property in Dubai comes with several benefits, including eligibility for residency visas and access to a tax-free environment.

Real Estate Regulations

The Dubai Land Department (DLD) oversees property transactions, ensuring transparency and compliance. The Real Estate Regulatory Agency (RERA) protects buyers by regulating the market and ensuring developers meet their obligations.

Title Deeds and Registration Process

All property purchases must be registered with the DLD to secure ownership rights. Title deeds serve as official proof of ownership and are critical for legal security.

The Buying Process

Finding the Right Property

Buyers can work with experienced real estate agencies or explore online property platforms such as Bayut and Property Finder to discover suitable options.

Financing Your Purchase

Mortgage options are available for both residents and non-residents, with eligibility depending on income, age, and credit history. Banks typically finance up to 75% of the property value for non-residents.

Negotiating and Closing the Deal

The process includes making an offer, signing a Memorandum of Understanding (MoU), and completing payments. Ownership transfer is finalized at the DLD.

Renting and Leasing in Dubai

How Renting Works in Dubai

Lease agreements outline the responsibilities of both tenants and landlords. Key terms include rental duration, payment schedules, and maintenance responsibilities.

Property Management Services

Investors living abroad can benefit from hiring property management companies to handle tenant relationships, maintenance, and rental income collection.

Taxes and Costs to Consider

Fees and Charges

Registration Fees: Paid to the DLD during property registration.

Broker Commissions: Typically 2% of the property price.

Service Charges: Cover building maintenance and amenities.

Tax Implications

Dubai’s tax-free policy on rental income and capital gains is a significant advantage. However, a 5% VAT applies to certain property transactions, such as commercial real estate.

Challenges and Risks in Dubai Real Estate

Market Fluctuations

The market can be volatile. Investors can mitigate risks by diversifying portfolios and focusing on high-demand locations.

Fraud and Scams

Buyers should verify the credentials of developers and agents. Ensuring the property’s title deed is valid and conducting due diligence are essential steps.

Selling Property in Dubai

Steps to Sell Property

Prepare the property by addressing maintenance issues and enhancing its visual appeal. Listing it on prominent platforms can attract potential buyers.

Working with Real Estate Agents

Agents can help streamline the selling process by providing market insights, managing listings, and negotiating on your behalf.

Why Dubai Real Estate Is a Smart Investment

High ROI for Investors

Dubai offers some of the highest rental yields globally, with rates ranging from 5% to 8% in prime areas.

Residency Visa Benefits

Investors can obtain a UAE residency visa by purchasing property worth AED 750,000 or more.

Stability and Growth Potential

Dubai’s long-term economic growth plans and infrastructure development ensure sustained demand in the real estate sector.

Conclusion

Dubai’s real estate market offers immense opportunities for investors and homebuyers. By understanding how Dubai real estate works, you can make confident and profitable decisions. For expert guidance, partner with Property Solvers real estate Agency to unlock the full potential of Dubai’s real estate market.

Dubai’s real estate market is one of the most dynamic in the world, attracting global investors and homebuyers with its luxurious properties, tax advantages, and robust infrastructure. Understanding the intricacies of how Dubai real estate works is crucial for making informed decisions and maximizing returns, whether you’re a first-time buyer or a seasoned investor.

Dubai's Real Estate Landscape

An Overview of Dubai's Real Estate Market Growth

Dubai’s real estate sector has seen exponential growth over the past few decades, with milestones such as the introduction of freehold property laws in 2002. Key players, including top developers like Emaar and Damac, alongside supportive government policies, have transformed Dubai into a global real estate hub.

Types of Properties Available in Dubai

Freehold Properties: Full ownership rights available to foreigners in designated zones.

Leasehold Properties: Long-term lease agreements, typically for 99 years.

Off-Plan Properties: Properties under construction, often offered at attractive prices with flexible payment plans.

Key Locations for Investment

Downtown Dubai: Home to iconic landmarks like the Burj Khalifa.

Palm Jumeirah: A luxury island community.

Dubai Marina: A vibrant waterfront district.

Emerging Areas: Spots like Jumeirah Village Circle (JVC) and Dubai South are gaining traction among investors.

Legal Framework and Property Ownership in Dubai

Property Ownership Laws for Foreigners

Foreigners can own properties in designated freehold zones, such as Dubai Marina and Downtown. Owning property in Dubai comes with several benefits, including eligibility for residency visas and access to a tax-free environment.

Real Estate Regulations

The Dubai Land Department (DLD) oversees property transactions, ensuring transparency and compliance. The Real Estate Regulatory Agency (RERA) protects buyers by regulating the market and ensuring developers meet their obligations.

Title Deeds and Registration Process

All property purchases must be registered with the DLD to secure ownership rights. Title deeds serve as official proof of ownership and are critical for legal security.

The Buying Process

Finding the Right Property

Buyers can work with experienced real estate agencies or explore online property platforms such as Bayut and Property Finder to discover suitable options.

Financing Your Purchase

Mortgage options are available for both residents and non-residents, with eligibility depending on income, age, and credit history. Banks typically finance up to 75% of the property value for non-residents.

Negotiating and Closing the Deal

The process includes making an offer, signing a Memorandum of Understanding (MoU), and completing payments. Ownership transfer is finalized at the DLD.

Renting and Leasing in Dubai

How Renting Works in Dubai

Lease agreements outline the responsibilities of both tenants and landlords. Key terms include rental duration, payment schedules, and maintenance responsibilities.

Property Management Services

Investors living abroad can benefit from hiring property management companies to handle tenant relationships, maintenance, and rental income collection.

Taxes and Costs to Consider

Fees and Charges

Registration Fees: Paid to the DLD during property registration.

Broker Commissions: Typically 2% of the property price.

Service Charges: Cover building maintenance and amenities.

Tax Implications

Dubai’s tax-free policy on rental income and capital gains is a significant advantage. However, a 5% VAT applies to certain property transactions, such as commercial real estate.

Challenges and Risks in Dubai Real Estate

Market Fluctuations

The market can be volatile. Investors can mitigate risks by diversifying portfolios and focusing on high-demand locations.

Fraud and Scams

Buyers should verify the credentials of developers and agents. Ensuring the property’s title deed is valid and conducting due diligence are essential steps.

Selling Property in Dubai

Steps to Sell Property

Prepare the property by addressing maintenance issues and enhancing its visual appeal. Listing it on prominent platforms can attract potential buyers.

Working with Real Estate Agents

Agents can help streamline the selling process by providing market insights, managing listings, and negotiating on your behalf.

Why Dubai Real Estate Is a Smart Investment

High ROI for Investors

Dubai offers some of the highest rental yields globally, with rates ranging from 5% to 8% in prime areas.

Residency Visa Benefits

Investors can obtain a UAE residency visa by purchasing property worth AED 750,000 or more.

Stability and Growth Potential

Dubai’s long-term economic growth plans and infrastructure development ensure sustained demand in the real estate sector.

Conclusion

Dubai’s real estate market offers immense opportunities for investors and homebuyers. By understanding how Dubai real estate works, you can make confident and profitable decisions. For expert guidance, partner with Property Solvers real estate Agency to unlock the full potential of Dubai’s real estate market.

Read other Blogs

Read other Blogs

Need a Consultation?

Please complete the form below, and one of our agents will reach out to you shortly.

Need a Consultation?

Please complete the form below, and one of our agents will reach out to you shortly.

Need a Consultation?

Please complete the form below, and one of our agents will reach out to you shortly.